Honoring a loved one’s lifetime of dedication typically involves heartfelt gestures, thoughtful gifts, and shared memories. Yet for one 74‑year‑old patriarch, a planned weeklong coastal retreat designed as a tribute to his fifty‑two years of unwavering service as a machinist transformed into an ordeal of abandonment and unintended financial burden. Confronted by a staggering $12,000 invoice he never authorized, he found himself alone in a luxury resort lobby—until his devoted grandson arrived to set things right.

This article presents a professionally rewritten account of that fateful vacation, expanded and structured for web publication. We trace the family’s intentions, the planning missteps, the week’s unfolding events, the moment of discovery, the emotional and legal aftermath, and the broader lessons on elder financial protection. Along the way, expert commentary, relevant statistics, and practical recommendations underscore the importance of communication, consent, and accountability in family affairs.

1. A Patriarch’s Legacy: Fifty-Two Years of Diligence and Devotion

1.1 From Humble Beginnings to Skilled Craftsman

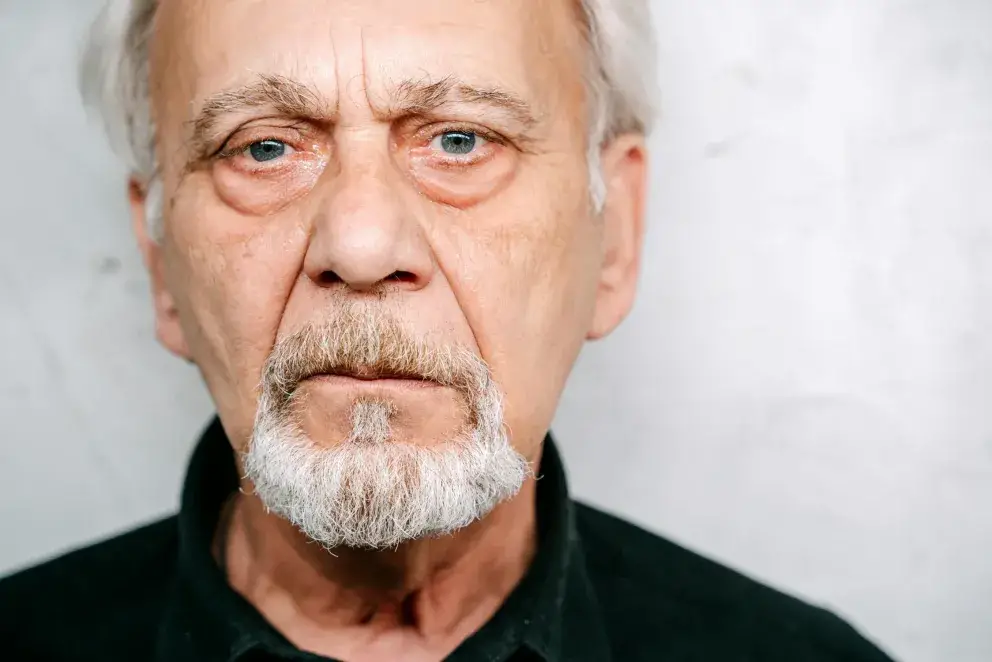

Born in 1949 in a small Midwestern town, the man at the heart of this story—henceforth “Grandfather”—was raised amid modest means but rich values. His parents instilled in him a profound work ethic and a respect for craftsmanship. At seventeen, he enrolled in a two-year vocational program specializing in machining, quickly distinguishing himself through precision, attention to detail, and an eagerness to learn.

Upon completing his apprenticeship, he secured a position at Westfield Precision Works, where he would remain for fifty‑two years. There, he mastered lathes, mills, and precision grinders; contributed improvements to tooling efficiency; and eventually rose to oversee a team of younger machinists. Colleagues recall that during his entire tenure he missed only four days of work—each time calling in to verify production progress before acknowledging his absence.

1.2 Beyond the Factory Floor: A Life of Generosity

Grandfather’s dedication extended far beyond his professional responsibilities. At home, he was the family’s quiet pillar of support:

-

Birthday Rituals: Every grandchild received a hand‑written card accompanied by a cash gift, regardless of economic conditions.

-

Neighborhood Handyman: From repairing leaky faucets to building custom shelving, he offered help without expectation of recompense.

-

Educational Mentor: He served for decades on the board of the local technical school, shaping apprenticeship programs that motivated dozens of students to pursue skilled trades.

“My father never sought recognition,” says his daughter (referred to here as “Aunt”). “He gave because it was who he was.” Such humility and generosity earned him deep respect in both his community and his family—setting the stage for what was intended to be a profound tribute to his lifelong contributions.

2. The “Thank-You Trip”: Intentions and Oversights

2.1 Conceptualizing the Celebration

Shortly after Grandfather announced his impending retirement, the family convened at a spring gathering to brainstorm how best to honor his fifty‑two years of service. Motivated by gratitude and affection, they settled on a seven‑night, all‑inclusive stay at an upscale coastal resort—complete with private balconies, spa treatments, and gourmet dining experiences.

Cousin Ashley, known for her organizational prowess, volunteered to coordinate every detail: flights, room reservations, and activity itineraries. Her proposal emphasized that all expenses would be covered by the family as a collective gift. Enthusiasm ran high as relatives agreed on dates, payments were pooled, and excited hashtags—#FamilyFirst, #RetirementKing—began circulating on social media.

2.2 Critical Missteps in Planning

Despite genuine goodwill, the trip’s foundation rested on key assumptions that would later prove costly:

-

Billing Under the Patriarch’s Name: The reservation was made in Grandfather’s name without establishing a separate family or corporate billing account.

-

Lack of Itemized Preview: No detailed cost breakdown for incidental charges (spa sessions, premium beverages, excursions) was shared with Grandfather in advance.

-

Verbal Reassurances vs. Written Consent: Repeated affirmations—“Don’t worry about money; it’s our gift”—substituted for any formal documentation or written confirmation of who would assume liability.

As the departure date approached, Grandfather, trusting his family’s assurances, packed lightly: a single suitcase, his favorite fishing hat, and a modest wardrobe suitable for seaside strolls. Meanwhile, social media became awash in gleaming promotional images—castles of cocktails, private cabanas, and candid smiles—instead of the financial disclosures that would have safeguarded the patriarch’s interests.

3. Days One Through Six: Surface Joy, Underlying Anxiety

3.1 Arrival and First Impressions

Upon arrival, the family was enveloped by the resort’s stunning setting: azure waters, palm‑lined walkways, and a lobby redolent with tropical blooms. Grandfather, who had spent a lifetime among steel and machines, expressed genuine awe:

“It was like stepping into a dream,” he later recalled. “I felt honored, but I also kept wondering if I was missing something.”

While relatives reveled in poolside champagne and spa pampering, Grandfather quietly received nightly folios—unsigned itemizations slipped under his suite door. Over appetizers and evening entertainment, he examined them with polite apprehension, refraining from voicing his concerns in deference to his family’s overt celebration.

3.2 The Quiet Weight of Worry

Hotel staff observed that Grandfather:

-

Asked Repeatedly: Inquired whether any signatures or deposits were required.

-

Apologized Often: Expressed regret about causing any inconvenience.

-

Deferred Decisions: Accepted his family’s insistence that costs were covered, despite his unease.

His reluctance to complain or question stemmed from decades of selfless giving—never wanting to appear ungrateful or burdensome. Yet beneath the festive facade, he shouldered growing uncertainty about who would ultimately foot the bill.

4. The Grandson’s Toughed Commitment

4.1 Balancing Work and Family Responsibility

A diligent young professional in the city, the grandson (the narrator) juggled demanding work commitments through the trip’s first six days. Yet he remained determined to join his grandfather for the return journey, aware of how disorienting airports could feel for the older man.

“He’s never been fond of airports,” the grandson explains. “They remind him of being out of control—something he’s never experienced in fifty‑two years on the job.”

Thus, he booked a one‑way flight timed to coincide with the hotel’s checkout on the final day, intending to ensure Grandfather’s safe transit home.

4.2 Anticipation and Initial Optimism

On the morning of his arrival, he envisioned a warm family reunion: hugs, stories of poolside adventures, and a shared sense of closure to a remarkable career. But as he stepped through the resort’s sliding glass doors, that optimism evaporated within seconds.

5. The Lobby Scene: Confrontation with Reality

5.1 The Moment of Betrayal

The grandson’s cheerful stride halted when he spotted Grandfather: alone, shoulders hunched, clutching a thick invoice that shook in his aged hands. The resort atmosphere—scented with sunscreen and orchids—felt surreal against the stark image of the elderly man confronting an unauthorized financial burden.

Grandfather (softly): “They told me it was their treat. I didn’t want to cause trouble.”

Behind him, the front‑desk staff waited politely, monitoring the senior’s distress. Meanwhile, the rest of the family had already departed—off to the airport, confident they had “taken care of everything.”

5.2 The Invoice’s Harsh Disclosure

Examining the document revealed:

-

Total Amount: $12,000

-

Itemized Charges: Five rooms at premium rates, multiple spa treatments, bar tabs for cocktails and champagne, boat rentals, sunset cruises

-

Billing Name: Grandfather’s, with no indication of external sponsorship

The gravity of elder financial exploitation—albeit unintentional by relatives—became painfully clear.

6. Emotional Dynamics: Dignity, Duty, and Outrage

6.1 A Patriarch’s Dignity Under Siege

For a man defined by meticulous precision and unwavering reliability, being reduced to a de facto guarantor for his family’s extravagance inflicted profound humiliation:

-

Apology and Shame: He murmured apologies to the desk clerk, convinced he had failed his family by not recognizing the arrangement.

-

Confusion and Hurt: Trusting his relatives’ assurances, he never anticipated abandonment in favor of a hefty financial burden.

-

Loss of Agency: His lifelong habit of giving without seeking acknowledgment now left him feeling taken advantage of—a betrayal that cut deeper than any mischarged spa fee.

6.2 A Grandson’s Protective Resolve

Witnessing his grandfather’s vulnerability ignited the grandson’s determination to rectify the situation. This was no longer merely about a misconstrued billing arrangement; it touched on principles of respect, transparency, and the moral duty to shield elders from abuse in any form.

7. Immediate Action: Confrontation and Rescue

7.1 Confronting Cousin Ashley

Before initiating legal recourse, the grandson sought answers from the trip organizer, cousin Ashley:

Grandson (voice measured but firm): “Why did you leave Grandpa with a $12,000 bill?”

Ashley (dismissive laughter): “He has savings. He can cover it.”

Grandson (tightly): “He never agreed to pay spa treatments, cocktails, or excursions. You made that decision without his consent.”

Ashley’s flippant reassurance—“We’ll discuss it at Thanksgiving”—underscored both her misunderstanding of consent and the family’s lack of accountability.

7.2 Paying the Invoice to Spare Further Distress

To prevent further emotional harm, the grandson took decisive steps:

-

Payment in Full: He presented his credit card to the desk clerk and covered the entire $12,000, ensuring staff would release his grandfather from further obligation.

-

Demanding Documentation: He requested a printed copy of the full invoice, itemized by room and guest name, with timestamps and signatures for every charge.

-

Securing Evidence: He arranged to receive service logs (spa, dinner, excursion) and security footage showing the family’s departure without Grandfather.

By absorbing the immediate financial burden, he spared his grandfather continued embarrassment—while preserving critical evidence for accountability.

8. Building a Case: Evidence Gathering

8.1 Documentary Records

Following payment, the hotel manager provided:

-

Itemized Invoice: Detailed list of charges attributed to each guest surname.

-

Service Logs: Times, descriptions, and costs of spa treatments, bar tabs, boat rentals, and other activities.

-

Signed Folios: Guest signatures authorizing incidental charges.

8.2 Visual Confirmation

Recognizing the value of visual proof, the grandson requested:

-

Security Footage: Lobby camera recordings capturing the family’s check‑out movements—luggage rolling past his grandfather, no backward glances.

-

Key‑Card Logs: Digital timestamps recording room entry and exit by each guest’s key card.

8.3 Staff Affidavits

Three front‑desk employees and one concierge provided brief written statements confirming:

-

The family’s directive to leave Grandfather to settle all charges.

-

Their observations of Grandfather’s confusion and reluctance.

-

The absence of any pre‑trip authorization from Grandfather for incidental expenses.

This multifaceted portfolio—financial, visual, and testimonial evidence—would form the backbone of any legal action.

9. Legal Strategy: Consulting Counsel and Drafting Notices

9.1 Engaging an Elder Law Attorney

Late that evening, the grandson consulted a trusted attorney specializing in elder law and consumer protection. The preliminary legal assessment identified grounds for potential claims:

-

Fraudulent Inducement: Misrepresentation that expenses were family‑sponsored when billed to Grandfather.

-

Financial Exploitation of a Vulnerable Adult: Unjust enrichment at the expense of an elder’s trust and unfamiliarity with group billing.

-

Abandonment: Leaving a senior citizen in a public accommodation without proper arrangements.

The attorney advised swift action to preserve evidence and establish liability.

9.2 Drafting Formal Demand Letters

Working closely with counsel, the grandson prepared concise, formal demand letters to each at‑fault relative (Aunt, Ashley, and adult cousins):

-

Statement of Liability: Clear identification of the recipient’s share of the $12,000 expense.

-

Legal Basis: Citation of applicable state statutes on elder financial abuse and contract law.

-

Payment Terms: Fourteen days from receipt to remit payment.

-

Consequences: Notice of intention to pursue small claims litigation for unpaid portions.

Each letter enclosed an itemized invoice with the recipient’s specific charges highlighted, eliminating any ambiguity.

10. Family Reckoning: Collection and Fallout

10.1 Digital Collection via Venmo

To expedite reimbursement, the grandson sent Venmo requests titled: “Your portion of Grandpa’s retirement trip. Due in 14 days.”

-

Ashley’s Response: A silent $4,000 transfer, accompanied by a bitter emoji as her display name.

-

Subsequent Payments: Aunt and remaining cousins each remitted their shares, some with terse acknowledgments, others reluctantly repeating claims of “misunderstanding.”

Within two weeks, the full $12,000 was recovered—reflecting the power of clear documentation and firm deadlines.

10.2 Personal and Emotional Repercussions

Although the financial matter resolved, familial relationships sustained lasting damage:

-

Holiday Exclusion: The grandson and his grandfather received no Thanksgiving invitations; minimal further contact was extended.

-

Eroded Trust: Grandfather, once blind to his relatives’ priorities, accepted the estrangement as evidence of true character.

-

Strengthened Bond: In the aftermath, grandfather and grandson forged a deeper connection, spending afternoons in the garden and evenings recounting life lessons over coffee.

11. Broader Context: Elder Financial Abuse in Perspective

11.1 Defining Elder Financial Exploitation

Elder abuse is defined by the World Health Organization as “a single or repeated act, or lack of appropriate action, occurring within a relationship where there is an expectation of trust, which causes harm or distress to an older person.” Financial exploitation accounts for nearly one in three reported cases globally.

-

Prevalence: Approximately 10% of seniors experience financial abuse annually.

-

Family as Perpetrators: Fewer than 40% of abuses are perpetrated by strangers; family members constitute the majority of offenders.

-

Economic Impact: Average losses range from $30,000 to $150,000 per victim.

11.2 Red Flags and Risk Factors

Common warning signs include:

-

Unexpected Bills: Large invoices in the elder’s name for services never expressly authorized.

-

Assumed Consent: Relatives making financial decisions without documented approval.

-

Isolation Tactics: Leaving seniors in unfamiliar settings to obscure accountability.

-

Behavioral Shifts: Anxiety, withdrawal, or unusual deference by the senior when discussing finances.

Recognizing these indicators can prompt timely intervention and prevent further harm.

12. Preventive Measures: Safeguarding Senior Relatives

12.1 Legal Tools

-

Durable Power of Attorney (DPOA): Assign a trusted agent to oversee financial decisions on behalf of the elder.

-

Advance Written Consent: For group vacations or large expenditures, require a signed agreement detailing costs and responsible parties.

-

Fiduciary Oversight: Engage neutral third-party fiduciaries or professional guardians when no family member can be fully trusted.

12.2 Transparent Communication

-

Detailed Budgeting: Share an itemized cost estimate prior to group trips.

-

Family Meetings: Conduct documented discussions outlining financial responsibilities.

-

Clear Billing Structures: Utilize corporate or pooled family accounts to separate individual liabilities.

12.3 Community Resources

-

Elder Rights Hotlines: National and state-level support lines offering advice and reporting guidance.

-

Protective Services: Adult Protective Services agencies that investigate suspected elder abuse.

-

Educational Workshops: Local senior centers and legal clinics providing training on recognizing and preventing exploitation.

13. Lessons Learned: Principles for Respectful Family Dynamics

-

Obtain Explicit Consent: Never assume an elder’s agreement to financial commitments—always secure documented approval.

-

Prioritize Dignity: Respect seniors’ autonomy and avoid placing them in positions of undue embarrassment or burden.

-

Implement Safeguards Early: Legal instruments like DPOAs and written agreements avert crises before they arise.

-

Act Decisively: Swift evidence gathering deters perpetrators and strengthens legal claims.

-

Foster Open Dialogue: Transparent communication builds trust and prevents misinterpretations that can fracture relationships.

14. Conclusion

What began as a well‑intentioned family tribute turned into a cautionary tale of misplaced assumptions and elder financial exploitation. A 74‑year‑old machinist—honored for decades of dedicated service—was abandoned at checkout with a $12,000 invoice he never agreed to sign. Yet through decisive action—paying the bill to spare his grandfather further distress, compiling irrefutable evidence, and holding relatives accountable—the grandson restored the elder’s dignity and sent a clear message: exploitation by kin will not stand unchallenged.

Today, grandfather and grandson share afternoons in the garden and evenings over coffee, strengthened by adversity and mutual respect. Their story serves as both a warning and a guide: clear communication, documented consent, and unwavering advocacy are vital to protecting our elders.